Page 1 of 2

On The Ledge

Posted: Thu Oct 09, 2008 2:20 pm

by MarleysGh0st

Since we haven't used this term in regard to the Phone Game in some years, it looks like we'll need to give the trademark back Wall Street.

The stock market went down

another 7% today.

Re: On The Ledge

Posted: Thu Oct 09, 2008 2:22 pm

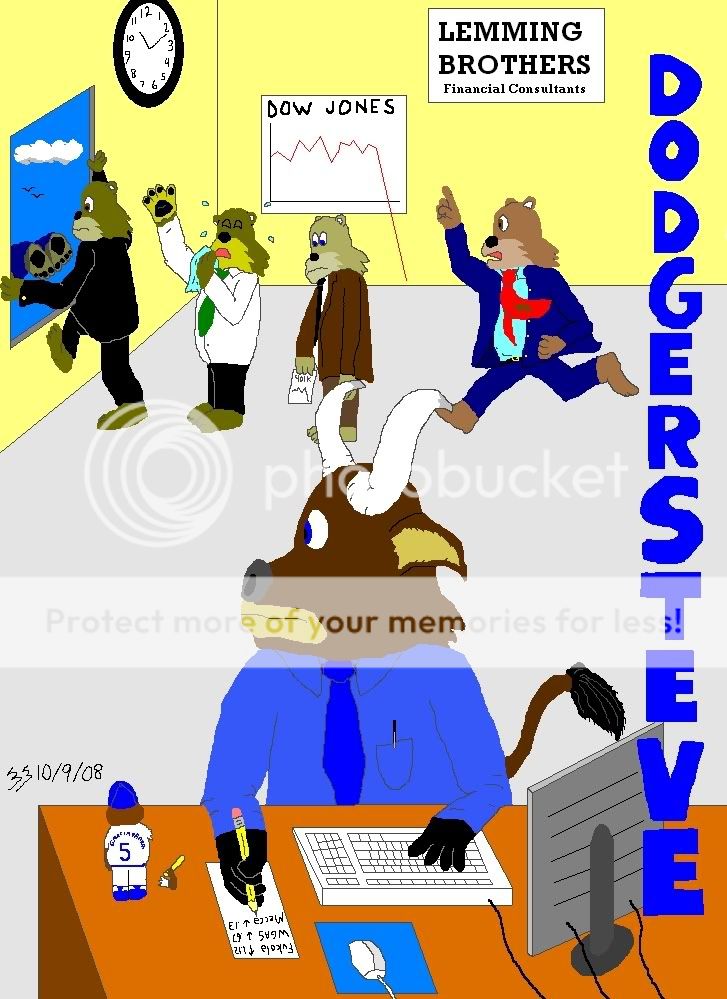

by Evil Squirrel

Re: On The Ledge

Posted: Thu Oct 09, 2008 2:34 pm

by MarleysGh0st

Evil Squirrel wrote:Look out below!!!!!!

Wow!

Do you really work that fast, Evil Squirrel, or did I just have an uncanny sense of timing in giving you your opening?

Re: On The Ledge

Posted: Thu Oct 09, 2008 2:37 pm

by Sir_Galahad

Just keep listening to the liberal media and house Democrats. They will tell you it's just a "correction."

Re: On The Ledge

Posted: Thu Oct 09, 2008 2:37 pm

by littlebeast13

MarleysGh0st wrote:Wow!

Do you really work that fast, Evil Squirrel, or did I just have an uncanny sense of timing in giving you your opening?

I should leave people to wonder how the squirrel does it, but let's just say he was quite happy to see that post less than half an hour after he finished that pic....

lb13

Re: On The Ledge

Posted: Thu Oct 09, 2008 2:40 pm

by MarleysGh0st

littlebeast13 wrote:MarleysGh0st wrote:Wow!

Do you really work that fast, Evil Squirrel, or did I just have an uncanny sense of timing in giving you your opening?

I should leave people to wonder how the squirrel does it, but let's just say he was quite happy to see that post less than half an hour after he finished that pic....

lb13

Well, I'm glad

someone's happy today!

Re: On The Ledge

Posted: Thu Oct 09, 2008 2:44 pm

by sunflower

I was happy earlier today. I was okay with the whole thing, but today is just ridiculous. I'm now sitting here eating peanut butter out of the jar with a plastic knife, reading news articles and wishing I had just spent my money instead of being responsible!!!

Re: On The Ledge

Posted: Thu Oct 09, 2008 2:48 pm

by silverscreenselect

With oil prices, what went up has to go down. With stocks, at some point, people are going to realize that a number of stocks are great bargains based on traditional measures of value such as earnings per share and they will start buying in earnest.

The 1929 Crash occurred because many stocks were ridiculously overvalued and being bought and sold mostly on credit and wild speculation. When the bubble burst, people woke up. The fundamentals of a lot of our industries are sound and if businesses can avoid severe liquidity crises, they will get through this in good shape. However, I feel some people naively expected the "bailout" to be a magic bullet that would right things overnight and are panicking because of that.

Which raises the question, just how much worse would things have gotten if the bailout hadn't passed?

Re: On The Ledge

Posted: Thu Oct 09, 2008 2:53 pm

by Bob Juch

Yeah, but NTN went up 27.78%.

Re: On The Ledge

Posted: Thu Oct 09, 2008 2:57 pm

by Weyoun

silverscreenselect wrote:With oil prices, what went up has to go down. With stocks, at some point, people are going to realize that a number of stocks are great bargains based on traditional measures of value such as earnings per share and they will start buying in earnest.

The 1929 Crash occurred because many stocks were ridiculously overvalued and being bought and sold mostly on credit and wild speculation. When the bubble burst, people woke up. The fundamentals of a lot of our industries are sound and if businesses can avoid severe liquidity crises, they will get through this in good shape. However, I feel some people naively expected the "bailout" to be a magic bullet that would right things overnight and are panicking because of that.

Which raises the question, just how much worse would things have gotten if the bailout hadn't passed?

I have to agree. The real issue is liquidity, and hopefully we are solving that now. I'd add that, now that Wachovia is being sorted out, no major bank is in danger of collapsing. The rest - Citi, Wells, Goldman, etc. - have weathered this, and of course the smaller regional banks are doing more than fine.

Re: On The Ledge

Posted: Thu Oct 09, 2008 3:00 pm

by Bob Juch

Weyoun wrote:silverscreenselect wrote:With oil prices, what went up has to go down. With stocks, at some point, people are going to realize that a number of stocks are great bargains based on traditional measures of value such as earnings per share and they will start buying in earnest.

The 1929 Crash occurred because many stocks were ridiculously overvalued and being bought and sold mostly on credit and wild speculation. When the bubble burst, people woke up. The fundamentals of a lot of our industries are sound and if businesses can avoid severe liquidity crises, they will get through this in good shape. However, I feel some people naively expected the "bailout" to be a magic bullet that would right things overnight and are panicking because of that.

Which raises the question, just how much worse would things have gotten if the bailout hadn't passed?

I have to agree. The real issue is liquidity, and hopefully we are solving that now. I'd add that, now that Wachovia is being sorted out, no major bank is in danger of collapsing. The rest - Citi, Wells, Goldman, etc. - have weathered this, and of course the smaller regional banks are doing more than fine.

Absolutely not! There's a long list of banks in trouble. I'll leave it to you as an exercise to use Google to find the list.

Re: On The Ledge

Posted: Thu Oct 09, 2008 3:03 pm

by Bob Juch

Oh, and Wachovia is not being sorted out. Now that they're looking at the actual loan portfolio, both Citi and Wells Fargo think they offered too much.

I expect what's going to happen tomorrow is that the FDIC is going to take over Wachovia and divvy it up between Citi and WF for next to nothing.

Re: On The Ledge

Posted: Thu Oct 09, 2008 3:09 pm

by Weyoun

Bob Juch wrote:Weyoun wrote:silverscreenselect wrote:With oil prices, what went up has to go down. With stocks, at some point, people are going to realize that a number of stocks are great bargains based on traditional measures of value such as earnings per share and they will start buying in earnest.

The 1929 Crash occurred because many stocks were ridiculously overvalued and being bought and sold mostly on credit and wild speculation. When the bubble burst, people woke up. The fundamentals of a lot of our industries are sound and if businesses can avoid severe liquidity crises, they will get through this in good shape. However, I feel some people naively expected the "bailout" to be a magic bullet that would right things overnight and are panicking because of that.

Which raises the question, just how much worse would things have gotten if the bailout hadn't passed?

I have to agree. The real issue is liquidity, and hopefully we are solving that now. I'd add that, now that Wachovia is being sorted out, no major bank is in danger of collapsing. The rest - Citi, Wells, Goldman, etc. - have weathered this, and of course the smaller regional banks are doing more than fine.

Absolutely not! There's a long list of banks in trouble. I'll leave it to you as an exercise to use Google to find the list.

There is "always" a list of banks in trouble - the FDIC announces the number regularly. My understanding is that it is around 120 - which is the highest since... 2003.

Re: On The Ledge

Posted: Thu Oct 09, 2008 3:10 pm

by silverscreenselect

Bob Juch wrote:Weyoun wrote:silverscreenselect wrote:With oil prices, what went up has to go down. With stocks, at some point, people are going to realize that a number of stocks are great bargains based on traditional measures of value such as earnings per share and they will start buying in earnest.

The 1929 Crash occurred because many stocks were ridiculously overvalued and being bought and sold mostly on credit and wild speculation. When the bubble burst, people woke up. The fundamentals of a lot of our industries are sound and if businesses can avoid severe liquidity crises, they will get through this in good shape. However, I feel some people naively expected the "bailout" to be a magic bullet that would right things overnight and are panicking because of that.

Which raises the question, just how much worse would things have gotten if the bailout hadn't passed?

I have to agree. The real issue is liquidity, and hopefully we are solving that now. I'd add that, now that Wachovia is being sorted out, no major bank is in danger of collapsing. The rest - Citi, Wells, Goldman, etc. - have weathered this, and of course the smaller regional banks are doing more than fine.

Absolutely not! There's a long list of banks in trouble. I'll leave it to you as an exercise to use Google to find the list.

No bank can survive a concerted run because all banks have the majority of their assets in investments that can't be easily liquidated for cash at anything resembling fair market value. So a run on virtually any bank could be fatal if the bank can't acquire emergency cash.

The type of liquidity crisis that banks were really facing was due to the fact that almost all their mortgage based securities (even those that were not subprime), are virtually impossible to sell right now at anything other than fire sale prices and they were showing bad balance sheets which meant that they in turn had to tighten up their lending practices considerably in a "circle the wagons" defense. This led to the possibility that even blue chip companies that rely on commercial paper for short term expenses like payroll could find that money very difficult to raise.

The change in accounting rules and easing the money crunch will help the banks out which will in turn help out the other companies. Will other banks fail? Yes, but the fallout will be manageable and will usually be tied to a much greater than average exposure to subprime loans.

Re: On The Ledge

Posted: Thu Oct 09, 2008 3:13 pm

by Weyoun

Bob Juch wrote:Oh, and Wachovia is not being sorted out. Now that they're looking at the actual loan portfolio, both Citi and Wells Fargo think they offered too much.

I expect what's going to happen tomorrow is that the FDIC is going to take over Wachovia and divvy it up between Citi and WF for next to nothing.

Really? The last I heard - and this is as of today - is that the Fed (not the FDIC) is trying to divide it up, yes, but that's because, while the Wells Fargo deal is plainly better, Citi probably needs the banking operations of Wachovia more.

I've seen absolutely nothing that suggests that either party wants to walk away from taking Wachovia at what is a very good price.

Re: On The Ledge

Posted: Thu Oct 09, 2008 6:39 pm

by Snaxx

Evil Squirrel wrote:Look out below!!!!!!

At first I just got a big black square and thought that might be the joke. After loading LB13's photobucket site in another browser, I came back, clicked on the black square, and it came up.

Re: On The Ledge

Posted: Thu Oct 09, 2008 7:05 pm

by Bob78164

Bob Juch wrote:Oh, and Wachovia is not being sorted out. Now that they're looking at the actual loan portfolio, both Citi and Wells Fargo think they offered too much.

I expect what's going to happen tomorrow is that the FDIC is going to take over Wachovia and divvy it up between Citi and WF for next to nothing.

What actually happened is that Citi backed off, although it is pressing its suit for damages. --Bob

Re: On The Ledge

Posted: Thu Oct 09, 2008 7:41 pm

by Bob Juch

Bob78164 wrote:Bob Juch wrote:Oh, and Wachovia is not being sorted out. Now that they're looking at the actual loan portfolio, both Citi and Wells Fargo think they offered too much.

I expect what's going to happen tomorrow is that the FDIC is going to take over Wachovia and divvy it up between Citi and WF for next to nothing.

What actually happened is that Citi backed off, although it is pressing its suit for damages. --Bob

Yep, I just got home and saw that.

Re: On The Ledge

Posted: Thu Oct 09, 2008 9:24 pm

by littlebeast13

jacorbett70 wrote:At first I just got a big black square and thought that might be the joke. After loading LB13's photobucket site in another browser, I came back, clicked on the black square, and it came up.

That is our new Nixon Spoiler box. I like it for unveiling ES's new drawings.... much more dramatic than the old Spoiler, though it is apparently not obvious that black box = spoiler.....

lb13

Re: On The Ledge

Posted: Fri Oct 10, 2008 12:21 am

by tubadave

littlebeast13 wrote:That is our new Nixon Spoiler box. I like it for unveiling ES's new drawings.... much more dramatic than the old Spoiler, though it is apparently not obvious that black box = spoiler.....

The spoiler= tag looks and works a lot more like the old tags did, I've noticed. It might work better for obscuring large items, like your pictures.

Re: On The Ledge

Posted: Fri Oct 10, 2008 12:24 am

by cindy.wellman

Hi Dave! (eom)

Re: On The Ledge

Posted: Fri Oct 10, 2008 7:23 am

by littlebeast13

tubadave wrote:littlebeast13 wrote:That is our new Nixon Spoiler box. I like it for unveiling ES's new drawings.... much more dramatic than the old Spoiler, though it is apparently not obvious that black box = spoiler.....

The spoiler= tag looks and works a lot more like the old tags did, I've noticed. It might work better for obscuring large items, like your pictures.

I didn't even notice there was a ready link to the other spoiler type.

OK, as much as I liked the black box, I think the spoiler= has a lot of potential too since I can add my teaser to the spoiler.....

lb13

Re: On The Ledge

Posted: Fri Oct 10, 2008 10:41 am

by Bob Juch

Bob Juch wrote:Bob78164 wrote:Bob Juch wrote:Oh, and Wachovia is not being sorted out. Now that they're looking at the actual loan portfolio, both Citi and Wells Fargo think they offered too much.

I expect what's going to happen tomorrow is that the FDIC is going to take over Wachovia and divvy it up between Citi and WF for next to nothing.

What actually happened is that Citi backed off, although it is pressing its suit for damages. --Bob

Yep, I just got home and saw that.

Citi's stock is up today even though just about everything else is down.

The market is going up and down like a yo-yo today.

Re: On The Ledge

Posted: Fri Oct 10, 2008 10:54 am

by gsabc

Re: On The Ledge

Posted: Fri Oct 10, 2008 10:57 am

by Bob Juch

Wells Fargo is talking advantage of a new tax "finding" that will allow them to save $20,000,000 in taxes. Citi was going to

give the FDIC $12,000,000 as sort of an insurance payment against future

possible losses.

Guess who loses?

You